The clock is ticking. Two weeks ago, TikTok announced the launch of the beta for its new streaming service in three new markets – Mexico, Australia, and Singapore – just a few weeks after it shared plans to roll out the app in Brazil and Indonesia. This suggests that the social media giant might also soon bring TikTok Music to the United States – although a source close to the matter claims TikTok has “no current plans” to do so.

However, if it does, TikTok Music could push the industry into a new, second generation of music streaming fueled by social media – and make ByteDance one of the most powerful and vertically integrated companies in the modern music business.

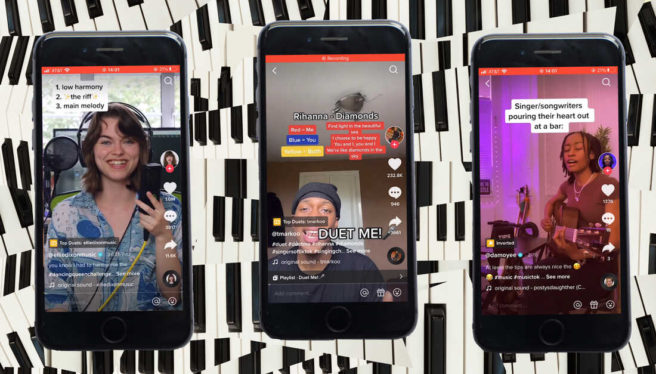

TikTok teased in a recent press release that TikTok Music will provide a “social music streaming” experience. Though it remains to be seen what the U.S. version of the forthcoming service will look like, a move to prioritize social interaction and cross pollination between the TikTok social app and its music streaming counterpart plays on the company’s greatest asset – and arguably also targets the incumbents’ greatest weakness.

The streaming services could be more social. It’s hard to find any examples of a music influencer that grew their following primarily on Spotify, Apple or Amazon. There is no longer a direct messaging feature on Spotify. There are practically no ways to engage with music beyond adding it to your personal library or clicking a “heart” icon. Unless, of course, the user leaves the app and shares a song to an Instagram story.

Instead, the current streamers invested in company-selected editorial playlists and radio stations. This allowed them to gain control in the promotion and marketing of music in the late 2010s and early 2020s as the streaming market in the United States began to mature. Top curators and hosts employed at Spotify and Apple in particular – like Zane Lowe or Tuma Basa – became modern kingmakers, much like radio DJs, MTV VJs, journalists and bloggers had been before.

But Billboard found that by late 2022, this was no longer moving the needle quite like it did just a few years before. At the peak of this model in 2019, a few high placements on key playlists often guaranteed a drastic influx of streams and interest from record labels, but its potency has since waned considerably. “There used to be a world where an unknown artist would get the cover of the Fresh Finds playlist [on Spotify] and they would get between 60,000 and 100,000 streams a week,” said one manager who works primarily with developing acts. “Now you’re looking at more like 15,000 to 20,000 streams a week.”

Instead, listeners – particularly Gen Z – increasingly turned to TikTok to find their new favorite songs, likely for its more interactive and organic feel; and labels in turn began offering lucrative contracts to artists who fared well on TikTok in the same way that they once offered deals to talent who landed on key playlists. In the words of MIDiA Research’s Tatiana Cirisano, the streaming services “cultural capital” was giving way to the China-based company which had become the most important place to market and promote music. As Chris Anokute, an A&R rep-turned-manager, previously put it to Billboard, “The biggest game in town is TikTok.”

The move into streaming, if successful, will allow TikTok to not only wield power over the marketing and promotion of music, but also the consumption of it. This, coupled with its popular music distributor and artist services company SoundOn, has the potential to make the company the most powerful in the industry today. With distribution, promotion, marketing and consumption all vertically integrated, ByteDance becomes a one-stop shop. (To take it even further, ByteDance also recently launched a music AI tool called Ripple, also inching the company into the music production process too).

SoundOn already has certain advantages over competitors like AWAL, Virgin and The Orchard: It can leverage access to TikTok data that lets signees identify promotional opportunities within the app. It can also afford to be a loss-leader, given that music is not ByteDance’s primary source of revenue. If SoundOn could add in the promise of editorial playlisting on a popular streaming service, it would be an even more formidable challenger for its competition. Today, traditional artist services companies cannot guarantee playlisting on any platform – all they offer is that their team will try. Imagine if an artist services company could guarantee social media success and playlisting for an emerging artist.

In many ways, TikTok’s democratization of music discovery is an exciting thing in that it has allowed artists without industry connections a chance to build an audience. But this comes at a cost. Today’s gatekeeper is not a music professional, it is an elusive, ever-changing algorithm, created by a company already criticized for its lack of transparency. In January, Forbes discovered that TikTok employees have access to a private “heating button” that can be employed to induce an uptick in video plays, and in March, a coalition of lawmakers cited potential issues with data privacy as a reason to ban the app nationwide. (Since then, Congress has gone mostly quiet on the idea of a TikTok ban.)

The incumbent streamers still have the upper hand against TikTok Music given their robust user bases. Though video streamers like Netflix, Hulu, and MAX struggle with constant cord cutting as users hop from service-to-service depending on their current film and TV offerings, music streamers generally offer the same catalog. This builds user loyalty to their music services and could possibly insulate Spotify, Apple and Amazon from a shiny new opponent like TikTok Music, even if that opponent’s experience proves better in some ways.

TikTok, however, has already influenced the rollout of new features on streaming services before it entered the streaming business itself. Take, for example, Spotify’s announcement earlier this year of a new vertical, swipeable discovery feed that sparked comparisons to the short-form video app, or its prior recruitment of TikTok-based music influencers – like Ari Elkins and Dev Lemons – to help popularize its now-defunct live audio app, Spotify Live. So even if TikTok can’t launch a streaming service that clinches the top market share, it will certainly continue to influence its competition even more than it already has. At the very least, TikTok Music’s launch signals the start of “music streaming 2.0,” – if not an even more seismic shift in power in the overall business.

https://www.billboard.com/pro/tiktok-music-streaming-service-impact-insustry-analysis/