Universal Music Group opened up about how the company plans to keep growing in amid an evolving streaming landscape on Tuesday at the company’s capital markets day. Held in the storied Abbey Road studios in London, UMG’s c-suite and various executives from Republic, Interscope, Virgin Music Group and more described how they build a world around superstars like Taylor Swift, The Weeknd and Olivia Rodrigo, and how they’ve launched new acts like the Afrobeats star Rema.

The crowd of mostly financial industry analysts and investors also got an overview of the collectibles UMG hopes superfans will open their wallets for, its talks with Spotify about higher-priced premium subscription plans, and it’s new strategy to keep streaming revenues growing by an 8-10% compound average growth rate until fiscal year 2028.

Streaming 2.0

Despite industry reports that new streaming subscribers are hard to find in developed markets and that streaming growth rates in smaller music markets like Brazil, Italy and Germany are besting major markets like the U.S., UMG Chairman and Chief Executive Officer Lucian Grainge gave an overview of UMG’s new strategy — dubbed Streaming 2.0 — to get more revenue out of streaming.

“The addressable market — in both established markets and fast-growing high potential music markets — is massive,” Grainge said, referring to streaming subscriptions. “We expect more than a billion subscribers by the end of the decade, and we constantly ask ourselves, ‘How long could it take us to get to 2 billion?’”

“While streaming has delivered robust growth to UMG for over a decade, Streaming 2.0 will deliver a new age of innovation, consumer segmentation, geographic expansion and greater value through both subscriber and [average revenue per user] growth,” Grainge said.

The strategy relies in part on increasing the number of streaming subscriptions in developing markets where UMG says subscribers meaningfully contribute to monthly trade average revenue per user. Less than half of people in established markets have streaming subscriptions, with less than 25% of the population in Japan holding subscriptions, UMG chief financial officer Boyd Muir said.

UMG said it also expects a new wave of subscribers in these markets to come from a second cohort of older listeners starting up subscriptions and younger, digitally native music fans getting older and spending more on their streaming subscriptions. They also expect to target audiobook listeners and satellite radio subscribers for music streaming subscriptions.

Super premium streaming subscriptions

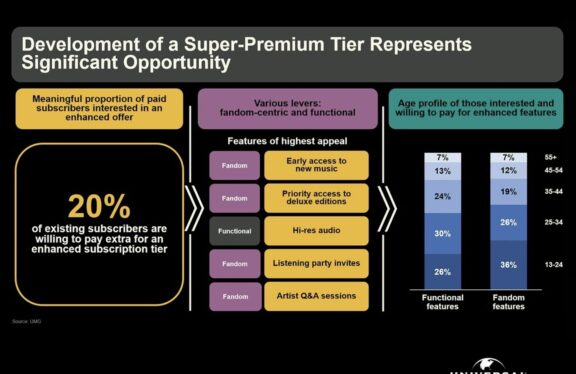

UMG’s Streaming 2.0 strategy also relies on innovation in streaming, possibly like the development of high definition streaming plans like the one Spotify‘s Daniel Ek hinted in June is on the horizon. Ek said that “delux” subscription could cost around $17-$18 per month for a single account.

UMG is in advanced talks to partner with Spotify on the development of that higher-priced subscription plan, Muir said Tuesday. During his presentation, UMG chief digital officer Michael Nash compared it to “another exciting” example of higher priced subscription plans — Tencent Music Entertainment’s super VIP tier, which costs five times as much as the standard tier.

Muir said “a double digit percentage” of TME’s subscriber base signed up for the super VIP plan. UMG’s own research tells it that 23% of current streaming subscribers would pay more for a “better music experience.”

Monetizing superfans

UMG execs spoke admiringly of the good old days when superfans lined up outside stores to spend gobs of money on Michael Jackson and Shania Twain CDs. The reason why? Devotees of artists in prior decades spent more per capita on music, merchandise, concert tickets and collectibles than streaming-era fans.

“Superfans, the most avid 20-30% of all music listeners, once drove over 70% of recorded music spending,” Muir said. “Streaming monetizes them, but not nearly as well in the past. This is an enormous opportunity. We are seeing dramatic growth in revenues that are complimentary to spending.”

He was referring to premium music — vinyl, collectible CDs and cassettes — and merchandise collectibles. UMG has seen its revenues from products sold directly to consumers through some 1,300 odd online stores grow at a 33% compound annual growth rate in recent years.

When something like a $55-Olivia Rodrigo Stanley Cup gets sold, UMG collects as much information as it can, and the purchaser becomes one of the 100 million fans in what Muir referred to as “our owned audience.”

https://www.billboard.com/pro/umgs-capital-markets-day-highlights-streaming-superfans/