For a firm whose bets are largely unpredictable, the early-stage venture firm Future Ventures has become very formulaic in its fundraising.

Now entering its fifth year, the firm just closed a $200 million fund – its third in a row. In fact, it would have exactly $600 million under management at this point if not for special purpose vehicles — pop-up funds, essentially — that it has raised to plow more money into some of its more capital-intensive companies and that bring the firm’s assets under management to $925 million.

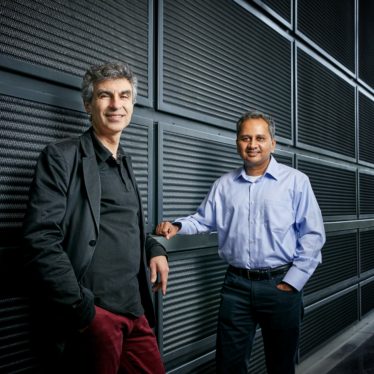

As we highlighted when the outfit closed its second fund in 2021, the team could raise far more if it wanted. Cofounder Steve Jurvetson is a veteran VC who has long been close to Elon Musk, spending more than 14 years on the board of Tesla before stepping off in the fall of 2020, holding a seat on the board of SpaceX for the past 14-plus years, and investing in Musk’s tunneling concern, Boring Company.

With Future Ventures cofounder Maryanna Saenko, the pair also wrote the very first check to Musk’s neurotechnology startup, Neuralink, while Saenko, a robotics expert with degrees from Carnegie Mellon, has driven investments in a wide number of similarly ambitious companies, including Commonwealth Fusion Systems, which is aiming to build a compact fusion power plant; 64x Bio, a gene therapy manufacturing company that raised $55 million last year; and Gameto, a reproductive health company that wants to egg freezing as routine as a tooth cleaning — and nearly as affordable.

Given their track record — Jurvetson was also an early investor in the now public satellite data company Planet Labs — the obvious question is why they keep raising the same, conservative amount for each fund, and the answer, suggests Saenko, boils down to strategy.

For one thing, Future Ventures has and remains focused exclusively on seed- and early-stage companies, writing initial checks of between $3 and $6 million, she says. In other words, it doesn’t need a lot of money considering what it’s putting to work.

It also helps that the firm – by its own telling – dives into startups where there isn’t a lot of competition from rival outfits at the outset, either because it’s a little “out there” or the time commitment is longer than most VCs can tolerate.

One such bet is The Better Meat Co. In a call earlier today with Saenko and Jurvetson, they raved about the five-year-old company, which has raised just $10 million to date, according to Crunchbase data, but that has enormous potential, in their view. “This is an alternative-protein-future-of-meat company [centered on a] type of fungus that grows more quickly than any other life form that you might consider as meat,” Jurvetson explained. “It goes from zero to harvest in 18 hours.”

Better Meat’s product, which has a meat-like texture and flavor profile, is sold as a meat-like product to other businesses at a cheaper cost than chicken or beef, says Jurvetson. But even better, he says, the “actual organism that they have patented for this production process has been part of the human diet for thousands of years in other products” so falls into a category of being “generally regarded as safe” by the FDA, meaning that it can go — and has — straight to market. (Many other plant-based alternatives to meat and seafood face a more complicated regulatory path.)

Another signature bet is ZaiNar, which leverages digital signal processing techniques to locate radio devices in 3D with what it says is meter-level accuracy. Think phones indoors and in dense cities; vehicles without a line of sight; and assets that use IoT devices in industrial environments.

Future Ventures has even bet on birth control for men, funding Your Choice Therapeutics last summer.

Naturally, we wondered what Saenko and Jurvetson think about the most futuristic-seeming trend of all right now: the dramatic advancements in AI that have the world so captivated. Were they as surprised as the rest of world by what ChatGPT released into the wild?

Notably, when we asked them both on the phone earlier today, both sounded a bit dubious.

“I think what I’ve been surprised by has been the public sentiment, offered Saenko. “The pace of AI innovation and its capacity to solve increasingly interesting problems in a compelling way — we’ve been marching to that drumbeat for quite a while now. And so it’s interesting to me that [ChatGPT’s release] in the broader social sphere was such a compelling inflection point that suddenly all of these people who frankly didn’t care at all about the space now can’t stop talking about it.”

Added Jurvetson, “It’s funny. My next meeting is with [our portfolio] company called Mosaic ML; Naveen [Rao] was formerly a founder in Nervana [a deep learning startup that sold to Intel for more than $400 million in 2016]. Now he offers these foundational models for everyone else. It’s kind of like democratizing access. So imagine you can build ChatGPT for under $500,000, which is still a big number, but it’s not $10 billion or $1 billion dollars depending on whose numbers you believe. It’s a much more interesting, scalable business proposition [because] basically they figured out a way to make this work more cheaply.”

He’s not bearish — quite the contrary, he’d said, but he also observed that people adapt to the future quite fast. “We should expect more and more examples like this, where they feel like magic, you give it a couple of years, and then it sort of fits into the fabric of society.”

With one glaring exception. Given that Jurvetson cut his teeth at Apple decades ago in a marketing role, we couldn’t help but ask why Siri is still so aggravatingly bad at so much, even with the phenomenal advancements happening in all around it in the world of AI.

Jurvetson said it “was a hairball of code that was marketed as a great breakthrough but really wasn’t a very scalable architecture. And [Apple has] been stuck with that.”

Saenko had a more generous take on why Siri still can’t get some of the simplest things quite right. “Siri fails in very knowable ways,” said Saenko. “It isn’t going to randomly start yelling at you or putting random events on your calendar or sending emails on your behalf that you didn’t intend.

“One could could make the argument that the [large language model] systems as they currently exist today have too much capacity to go haywire if you give them too much power. Maybe that’s what Apple has indexed on, because if you think about it, the products they put out in the world are really pretty fully baked.”

You can check out the rest of Future Ventures’s portfolio here. If you want to scan their latest fund filing, that was just processed here.

Talking with Future Ventures about its new fund, AI hype, and Siri sucking (still) by Connie Loizos originally published on TechCrunch