When engaging with our portfolio companies as well as with new investment opportunities, we’ve noticed that “profitability” and “efficiency” are two words that are often grouped with “growth” in every sentence.

Three months into 2023, investors continue to use buzz words like “responsible growth,” “business efficiency” and “quality marketing” when explaining how VC-backed companies should do business this year. That may be true, but there is no textbook for how a company can actively reduce its budget without slowing down growth in the near term.

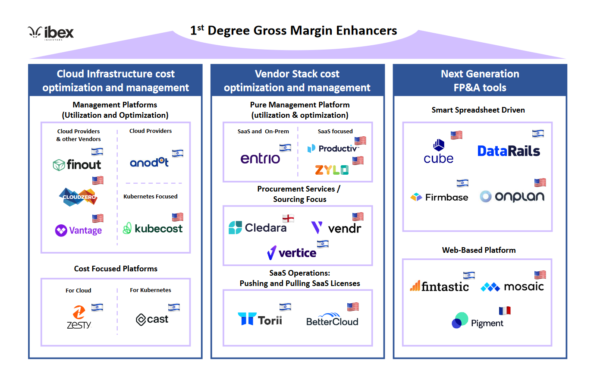

Over the past few months, we have examined, demo’d and reviewed over 30 companies that we define as “first-degree, gross-margin-enhancing businesses.”

What does this mean? The “first-degree” part of that has to do with the now. Investors are knocking at the door to see improvements every quarter. Companies that can help you with long-term efficiencies will not help you when you next look to raise money in six, 12 or 18 months.

The “gross-margin-enhancing” part of this definition is important because simply reducing costs in lieu of growth will not work. Likewise, maximizing growth with little sensitivity around costs won’t work in 2023.

Image Credits: Ibex Investors

In this article, we’ll look at emerging companies that can efficiently and effectively support organizations in their efforts to deliver growth while optimizing and managing costs in the near and long term.

Given the market right now, investors want to see companies following forecasts more than ever.

The value proposition of the companies in this mapping is to help businesses continue their growth journey while optimizing and reducing costs in their current business structure. That said, there is no-one-size-fits-all solution. For this reason, we have defined three key categories of gross margin enhancement:

- Cloud infrastructure cost optimization and management.

- Vendor stack cost optimization and management.

- Next generation FP&A tools.

Cloud infrastructure cost optimization and management

There is a constant struggle to balance stepping on the gas to improve product (i.e., raise cloud spend) and pushback from the CFO’s office when it is time to cut back.

CTOs and technical leads know how to cut cloud costs, but it can be difficult to pinpoint to what degree a certain change can negatively impact a company’s top line, not to mention the time it takes to execute reduction and optimization requests repeatedly. Companies want to continue to grow and do it rapidly, but they simply cannot allow themselves the freedom to flex their cloud spend like in past years.

Several companies are solving these problems with different focuses: Finout, Cloud Zero, Vantage and Anodot support both enterprise and middle-market end users and offer solutions to manage the cloud as well as Kubernetes. Some of these players provide solutions not only to support key cloud providers but also other cloud infrastructure vendors (such as Data Dog and Snowflake).

Other companies focus on more specific use cases. For example, Kubecost focuses on Kubernetes management. There are also companies that aim to help you cut costs: Zesty (for cloud) and Cast (for Kubernetes) fall in this space.

Q1 2023 market map: SaaS cost optimization and management by Ram Iyer originally published on TechCrunch

https://techcrunch.com/2023/03/10/q1-2023-market-map-saas-cost-optimization-and-management/