Global demand for K-pop and strong first-quarter results are helping South Korean music companies outperform the stock market as well as their music industry peers.

Through Tuesday (May 16), shares of the four largest K-pop companies — HYBE, SM Entertainment, YG Entertainment and JYP Entertainment — have risen an average of 75.1% year to date compared to 8.3% for the S&P 500, 19.4% for the Nasdaq composite and 11.6% for the Korean Composite Stock Index.

K-pop companies are vastly outperforming other music companies, too. Shares of the two largest publicly traded standalone music companies, Universal Music Group and Warner Music Group, have declined 15.6% and 25.2%, respectively, through Tuesday. The Billboard Global Music Index, a collection of 21 publicly traded music companies, is up 3% year to date. The index’s best-performing major company outside of South Korea is Spotify, whose cost-cutting measures and continued subscriber growth have led to an 84.9% increase in its share price through Tuesday.

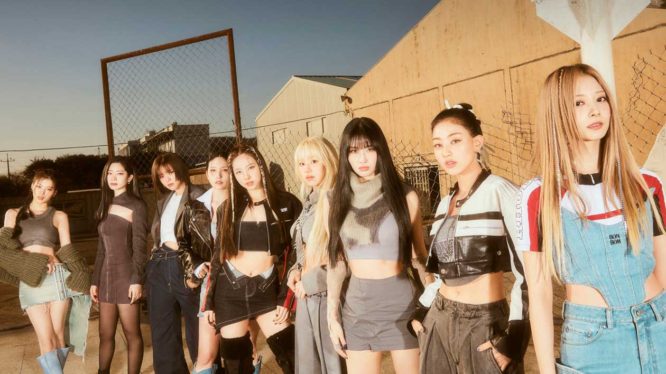

Shares of YG Entertainment, the company behind K-pop success Blackpink and hot newcomer BABYMONSTER, rose 17.1% to 78,100 KRW ($58.59) on Friday (May 12) — a 52-week high — after the company’s first-quarter earnings results showed that revenue rose 108.6% to 157.5 billion KRW ($118.2 million) and net profit soared 437.5% to 31.3 billion KRW ($23.5 million) from Jan. 1 to March 31. After rising another 9.4% on Tuesday and 7.4% on Wednesday (May 17), YG’s share price is up 108.2% year to date.

Shares of JYP Entertainment — whose roster includes Stray Kids and Twice — soared 20.8% to 115,400 KRW ($86.57) on Tuesday and have gained 70.2% year to date. The share price soared after JYP announced that its first-quarter revenue grew 74.1% to 118 billion KRW ($88.5 million), gross profit improved 92.1% and net income climbed 155.1% to 42.7 billion KRW ($32 million). Album sales grew 66% on the strength of releases by Stray Kids, Twice and NMIXX and included about 12 billion KRW ($9 million) of sales of albums through Republic Records, JYP’s partner in the U.S. since 2020. At the end of the quarter, Twice’s latest album, Ready to Be: 12th Mini Album, debuted atop the Billboard Top Album Sales chart. Concert sales rose 106% while merchandise sales jumped 274%.

SM Entertainment revenue rose 20.3% year-over-year to 203.9 billion KRW ($153 million). Gross profit grew just 4.9% to 72.2 billion KRW ($52.2 million), however, and net income declined 10% to 23 billion KRW ($17.3 million). SM’s concert revenue grew more than 26-fold to 19.2 billion KRW ($14.4 million) due to the resumption of the live concert business following the COVID-19 pandemic slowdown. SM artists performed in 55 concerts in South Korea in the quarter — 13 by NCT Dream and 9 by NCT 127 — compared to zero in the prior-year period. Merchandise and licensing revenue climbed 67.4% year-over-year to 29.3 billion KRW ($22 million). Appearance revenue grew 16.1% due to an increase in advertising appearances.

While SM Entertainment’s share price has risen 47.7% year to date, its closing price of 113,300 KRW ($85) on Tuesday is well below the 150,000 KRW ($112.52) per share paid by Kakao Entertainment in March for a 35% stake in the company. Still, SM Entertainment has benefitted from the battle for its control between Kakao and HYBE, its partnership with Kakao and changes to its executive team and board of directors. Prior to severing ties with its founder, Lee Soo-man, in October 2022, SM Entertainment shares were trading at 63,200 KRW ($47.41) — 44.2% lower than its closing price Tuesday.

HYBE’s share price is up 63.7% year to date — a considerable comeback after falling 50.3% in 2022 after the company’s primary revenue source, BTS, announced it would go on hiatus. The stock rose 5.4% on May 2 after the company announced its first-quarter revenue jumped 44% and album sales improved almost three-fold. And although investors are concerned about HYBE’s ability to replace lost BTS sales, its first-quarter operating margin of 12.8% was about equal to the margin in the prior-year period.

Share prices often reflect narratives about companies’ futures, not just recent financial performance. Like the other K-pop labels, HYBE pitches investors a multi-national growth story that builds on success in its home country. “Although we are mostly focused on K-pop artists at the moment,” Kyung-Jun Lee, HYBE’s CFO, told investors during the May 2 earnings call, “three to five years from now, as we start expanding into the global markets, including the U.S., Europe and Japan, we will definitely have established greater balance in terms of our geographical coverage.” Likewise, SM Entertainment revealed plans for a North American expansion in partnership with Kakao Entertainment, and JYP Entertainment has pending projects in the United States (A2K), China (Project C) and Japan (NiziU 2) in what it calls the “glocalization” phase of its expansion beyond its borders. This sort of global growth, if successful, will yield long-term gains — and that’s exactly what investors want to hear.

https://www.billboard.com/pro/k-pop-stocks-rise-quarterly-earnings-strong-growth/