Global music sales rose for the eighth consecutive year in 2022, with recorded music revenues growing in every world market and across almost all formats, according to the International Federation of the Phonographic Industry’s (IFPI) “Global Music Report 2023.”

Total revenues climbed to $26.2 billion, a rise of 9% on the previous year. Although that rate of growth is half 2021 year’s rise, when revenues were up 18.5% year-on-year, IFPI said it was still the fourth highest growth level the recorded music business has seen this millennium.

The leading driver of growth was a 10.3% rise in paid-for streaming subscription revenue, which totaled $12.7 billion last year. IFPI reports there were 589 million users of paid subscription accounts at the end of 2022, up from 523 million in the previous 12 months and 443 million in 2020.

Streaming (including paid subscription and advertising-supported) now accounts for 67% of sales across the music industry, up from 65% in 2021 and 62% in 2020, although rate of growth is slowing.

In 2021, streaming revenues rocketed 24% to $16.9 billion. Last year, total revenues streaming revenues increased 11.5% to $17.5 billion.

Despite the dominance of streaming, physical music formats continue to be resilient with CD and vinyl revenues increasing for a second consecutive year — albeit at a slower rate than 2021’s 16.1% rise, fueled by a post-pandemic boom in home music purchases — to $4.6 billion, up 4% on the prior year.

Within physical music revenues, last year’s growth in CD sales proved to be a fleeting uplift with revenues falling 0.4% in 2022. Vinyl revenues shot up 17.1% (IFPI did not provide revenue numbers for CD or vinyl sales).

In terms of market share, physical accounted for 17.5% of the overall market last year (down from 19.2% in 2021) with Asia generating almost half (49.8%) of all global revenues for physical music sales.

Performance rights revenue climbed 8.6% to $2.5 billion, representing 9.4% of global revenues, while sync income was up 22.3% to $0.6 billion, representing 2.4%.

Downloads and what IFPI classifies as other (non-streaming) digital formats was once again the only format channel to record a decline, falling 11.7% to $900 million and representing just 3.6% of the global market.

As per previous year’s reports, IFPI uses current exchange rates when compiling its Global Music Report, restating all historic local currency values on an annual basis. Market values therefore vary retrospectively as a result of foreign currency movements, says IFPI, which represents more than 8,000 record company members worldwide, including all three major labels, Universal Music Group, Sony Music Entertainment and Warner Music Group.

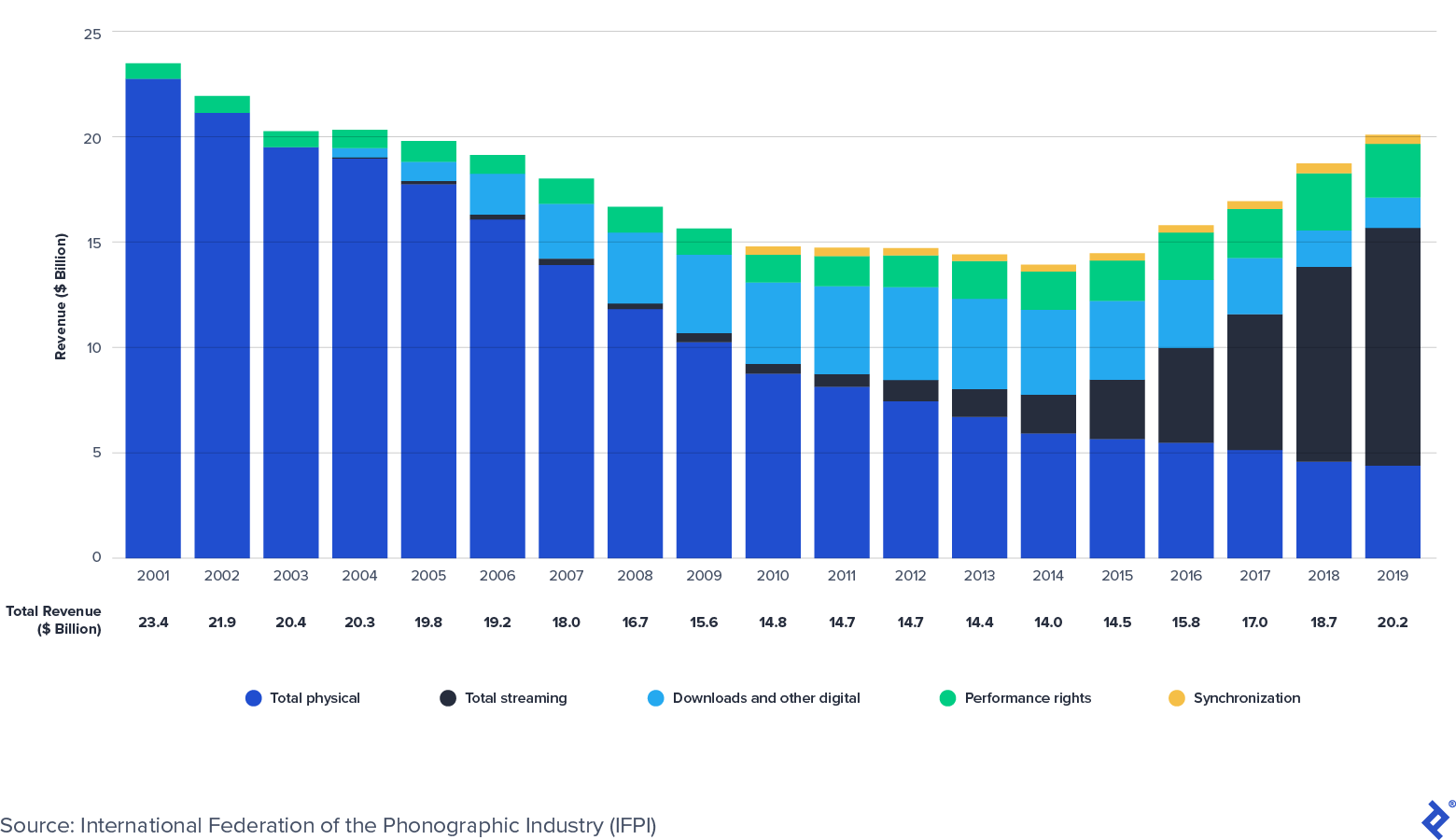

Thanks to sustained growth in streaming, global recorded music revenues have now reached their highest level since 1999 — when music sales totaled $22.3 billion – on an absolute dollar basis, not accounting for inflation, reports IFPI. Piracy and declining physical sales saw the market bottom out at $13.1 billion in 2014.

“Record companies’ investment and innovation has helped make music even more globally interconnected than ever,” said IFPI chief executive Frances Moore in a statement, accompanying the report.

As the music economy grows, however, “so too do the areas in which record companies must work to ensure that the value of the music artists are creating is recognized and returned,” Moore warned.

Referring to the ongoing threat of music piracy, she said the challenges for record companies, artists and creators are “becoming increasingly complex as a greater number of actors seek to benefit from music whilst playing no part in investing in and developing it.”

Writing in the report’s foreword, Universal Music Group chairman and CEO Sir Lucian Grainge said “to succeed, music’s future must be artist-centric.” He called on the industry to focus on building a “robust, growing and sustainable music ecosystem” in which “creators of all music content, whether in the form of audio or short-form video, are fairly compensated and can therefore thrive for decades to come.”

IFPI’s Global Music Report 2023 Topline Figures:

- Global music sales up 9% to $26.2 billion

- Streaming subscription revenues up 10.3% to $12.7 billion

- Total streaming revenues (including paid and ad-supported) up 11.5% to $17.5 billion

- Physical revenues up 4% to $4.6 billion

- Performance rights revenues rise 8.6% to $2.5 billion

- 589 million paid music subscribers

- Streaming’s share of global music sales: 67%

In terms of world markets, the U.S. retains its number one position with music sales growing 4.8% and exceeding $10 billion in recorded music sales for the first time.

Japan holds steady in second place with sales growing 5.4% in 2022. The third and fourth-biggest markets for recorded music remain the United Kingdom (+5.4%) and Germany (+2.2%), respectively.

The rest of the top 10 is made up of China (+28.4%), which becomes a top five global market for the first time, France (+7.7%), South Korea, Canada (+8.1%), Brazil (+15.4%) and Australia (+8.1%).

IFPI said that music sales were up in all 62 of the global markets it tracks. The organization’s free-to-access report does not provide market-by-market revenue breakdowns.

On a regional basis, it was a similar story with revenues from the U.S. and Canada region up 5%, while Latin America – where streaming now accounts for 85.2% of the market — saw growth of 25.9%

The fastest-growing market region in 2022 was Sub-Saharan Africa, which recorded a 34.7% rise in music sales, largely driven by the booming music market in South Africa, where sales were up by more than 30% year-on-year.

Revenues in Middle East and North Africa, last year’s fastest growing region, rose by almost 24%, driven almost entirely by streaming, which has 95.5% share of the region’s recorded music market – the highest share for any region worldwide, reports IFPI.

Revenues in Europe, the second-largest recorded music region in the world after the U.S. and Canada, grew by 7.5% — compared to the prior year’s growth rate of 15.4% — driven by gains in Europe’s three biggest markets, the U.K., Germany and France. Asia grew by 15.4%.

https://www.billboard.com/pro/ifpi-global-report-2023-music-business-revenue-market-share/