Of all Jimmy Buffett‘s accomplishments, from classic hits such as “Margaritaville” and “Changes In Latitudes, Changes In Attitudes” to building a billion-dollar travel-and-lifestyle empire, one of the biggest was an unprecedented, decades-long amphitheater deal in which he received a whopping 105% of the gross ticket receipts. This anti-mathematical trick stunned the concert business.

“Early in our careers, we would all whisper about Buffett’s rumored deal. Could he possibly be getting not just the lion’s share of the show profits, but all of the box-office gross? Or in some cases more than the box-office gross? What?” asks Fielding Logan, a Q Prime manager who represents country star Eric Church. “Like a mythical white whale, we’ve been chasing that deal ever since.”

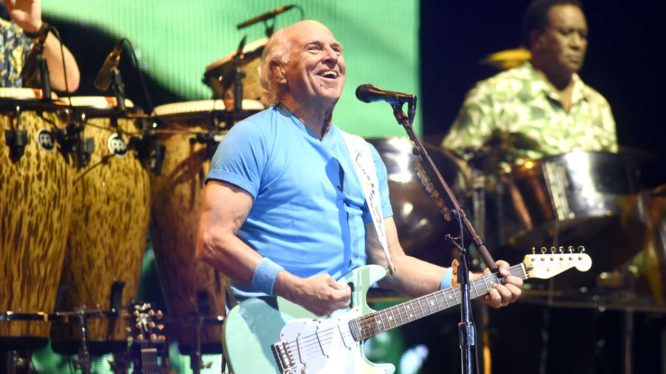

How did Buffett, who died Friday at 76, pull off this legendary deal, which several concert-industry sources confirm was in place through his very last amphitheater tours?

In the late 1990s, when SFX Entertainment bought out promoters around the country, the new concert-business giant offered touring stars huge payments to anchor its summer-amphitheater lineup — and avoid losing them to rival companies. Back then, artists were asking — and receiving — 90% of the net ticket sales after expenses, leaving 10% to the promoter.

Buffett took this trend to a new level on his annual summer runs, which drew more than 3.9 million fans and grossed $215.4 million over 196 shows in the 2000s, according to Billboard Boxscore. “Here’s the thing about Jimmy: 90-10 wasn’t good enough for him. He started demanding 105%! All of the gate plus 5% of the gross,” Barry Fey, the late Denver promoter who competed with SFX at the end of his career, wrote in his 2011 book Backstage Past.

Promoters agreed, knowing they could take a cut of ancillary revenues, like parking, food and ticket service charges and — especially with Buffett’s hard-partying Parrotheads — alcohol. “It worked out for me and the other promoters because of beer sales,” Fey wrote.

In 2000, Clear Channel Communications bought SFX, then spun off the concert-promotion business into a new company known as Live Nation — which maintained his deal, sources say. So, for example, in 2005, when Buffett’s show at Arrowhead Pond (now the Honda Center) in Anaheim, Calif., made $1.13 million at the box office, according to Billboard Boxscore, Buffett would have taken home roughly $1.136 million.

Buffett, who toured through spring 2023, set a financial precedent that younger stars, such as country singer Kenny Chesney, were able to replicate, according to sources. “Jimmy was a key artist in establishing and solidifying the amphitheater model,” says Brock Holt, a longtime Nashville promoter who is now a touring consultant, “and opened the doors for a higher financial return for artists.”

“He was the only one who had the leverage to do it. He toured perennially and did the same amount of business each time. The Parrotheads came out. It was a yearly ritual,” says Randy Phillips, former CEO of promoter AEG Live, and now a consultant for Silver Lake, an investment group whose portfolio includes Madison Square Garden Sports and Endeavor. “He was the anchor to Live Nation’s schedule so it was really critical. He used that to negotiate.”

Buffett’s longtime touring reps, including Live Nation, attorney Joel Katz and agent Howard Rose, did not respond to requests for comment.

https://www.billboard.com/pro/jimmy-buffett-negotiated-one-of-best-deals-touring/