The last decade saw many tech companies embracing product-led growth (PLG) and bottoms-up sales strategies, as opposed to traditional enterprise sales, to drive their go-to-market strategies and overall growth.

Many software startups loved (and still love!) the bottoms-up approach. What’s not to like about designing a software product to “sell itself” through viral adoption and word-of-mouth marketing? Bottoms-up and PLG both promise a faster sales cycle at a much lower cost – no more golf and pricey steak dinners on the expense account.

PLG offers other strategic advantages, too: By shortening the feedback loop between users and product teams, it allows early- and growth-stage tech companies to land and expand use of their technology inside corporate accounts, with internal champions driving the sale.

However, as enterprise-tech buyers watch expenses more closely these days, they are also tightening restrictions on self-procurement. This means founders who’ve become highly reliant on bottoms-up need a more robust enterprise-sales strategy, fast.

It’s too soon to pronounce bottoms-up dead, but it’s looking pretty moribund. And ‘pure’ PLG needs to shift rapidly too. Today’s PLG needs to inform both the product and sales teams so they can work smoothly together and clinch the next deal.

Enterprise software spending: Slower deal cycles, more scrutiny

Some clues about this changing face of corporate tech spending can be found in our latest Battery Ventures State of Cloud Software Spending Report, which queried 100 chief technology officers, chief information officers and other large tech buyers across industries ranging from financial services to healthcare to manufacturing.

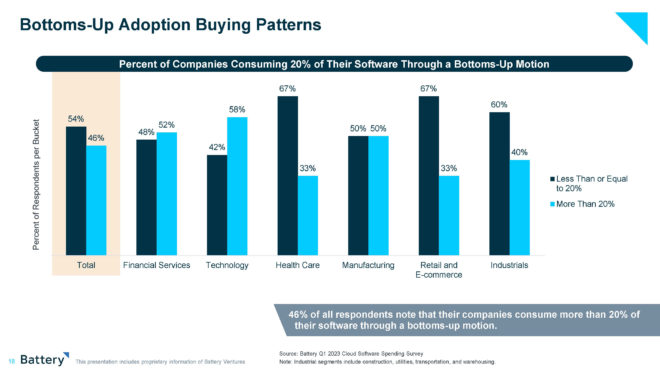

Collectively, the survey respondents represent $30 billion in annual technology spending. Our respondents include a healthy sampling of enterprises that consume software through a bottoms-up / PLG motion, as the slide below indicates.

Bottoms-up adoption buying patterns Image: Battery Q1 2023 Cloud Software Spending Survey

While almost half of our respondents (46%) expect to increase their total technology budgets in 2023, enterprises are getting more conservative and shifting priorities. Many plan to standardize spending, consolidating vendors to save money and optimizing SaaS licensing. Enterprises are re-examining pricing models to determine if consumption- or seat-based pricing makes the most sense, given how the software is used, and choosing vendors partly on that basis.

Today’s PLG needs to inform both the product and sales teams so they can work smoothly together and clinch the next deal.

The sometimes-bureaucratic governance systems within enterprises may function even more slowly in the coming months, as organizations across industries work to become more efficient and to increase spending oversight.

The slide below quantifies our findings that bottoms-up and PLG adoption are slowing down. One example: Only 46% of survey respondents now allow individual engineers to install tools in a “sandbox dev” environment – that’s down from 76% since our last survey in September 2022. The drop for engineer-selected tools deployed into production is significant too: Now, only 11% of enterprises allow this to happen, down 27% from September 2022.

Have enterprise buyers finally soured on ‘bottoms-up’ tech sales? by Walter Thompson originally published on TechCrunch

https://techcrunch.com/2023/05/30/have-enterprise-buyers-finally-soured-on-bottoms-up-tech-sales/