With inflation sparking an increase in the cost of repairs, labor and claims, fees for insurance are similarly spiking across the board. Car insurance premiums rose 13.7% nationally over the past year, according to a study from Bankrate.com. Home insurance, meanwhile, climbed 12.1% year-on-year, Policygenius found.

But Jonathan Matus argues that it doesn’t have to be that way. He’s the founder of Fairmatic, a company that’s applying AI to — at least according to him — reduce risk in the car insurance industry.

Matus previously founded Zendrive, a platform that provides insights to enterprises for car insurance underwriting and claims as well as roadside assistance. While Zendrive is focused on insurance for individuals and families, Fairmatic has a more commercial bent — a customer base made up primarily of businesses.

“Having spent about a decade of my career at Google and Facebook, I quickly noticed the negative externalities of the technology I actively helped become widespread,” Matus told TechCrunch in an email interview. “The path to Fairmatic’s inception was created out of a need to de-risk one of the worst externalities of this powerful technology: the increase in distracted phone use while driving and subsequent loss of lives on the road.”

Matus might speak in grandiose terms, but Fairmatic’s business proposition is simple: analyzing and pricing a vehicle fleet’s risk profile. The company uses AI models trained on driving data to attempt to mitigate risk and assist with various policy management and claims processes.

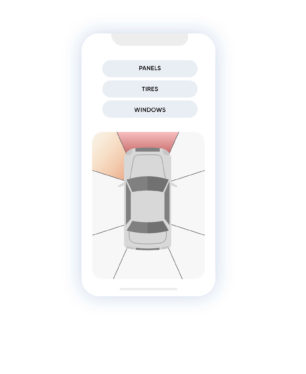

Customers get access to an app that they can use to monitor “driving events” — e.g. erratic driving — and “identify actionable improvement opportunities.” The app also offers what Fairmatic calls a “fully digital mobile claims experience” that can automatically detect crashes (hopefully better than Apple) and analyze incident data.

Here’s Matus: “With Fairmatic, small, medium and large enterprise fleets are empowered with actionable insights that improve safety and have a direct impact on insurance savings.”

But there’s reasons to be skeptical. Fairmatic isn’t the first to bring AI to car insurance decisioning — Jerry, Just, Root and Tractable offer similar technologies, albeit targeted at consumers — and AI has a spotty track record in the insurance industry.

Last year, the Casualty Actuarial Society (CAS), the professional society of actuaries specializing in property and casualty insurance, acknowledged the prejudicial effects AI might have when used by financial institutions in determining insurance and mortgage lending. In a series of papers, the CAS concluded that biased data — data on which insurers train their algorithms — could perpetuate the discrimination that already exists in the insurance industry. (See: Allstate’s pricing algorithm that disproportionately negatively impacted nonwhite customers.)

Fairmatic applies AI to commercial auto insurance. Here, its app detects a crash automatically. Image Credits: Fairmatic

A subsequent report from the California Department of Insurance called out especially problematic recent applications of AI by insurers, including flagging claims from inner-city ZIP codes and using personal information unrelated to risk in marketing and underwriting insurance policies. “Conscious and unconscious bias or discrimination … can and often does result from the use of AI, as well as other forms of ‘big data’,” the authors of the report wrote.

Washington and Oregon have sought to ban the use of credit-based scoring algorithms to set auto insurance premiums. Separately, Colorado has introduced legislation requiring insurers to test their algorithms and scoring models to uncover biases.

Matus is adamant that Fairmatic takes care to reduce the potential for bias in its AI. In fact, he argues, Fairmatic’s reliance on AI generally leads to better outcomes for customers, who’ve historically been stuck with insurers using antiquated data and pricing models.

“Fairmatic’s AI predictive risk model has been trained using over 200 billion miles of driving data,” he said. “This allows us to develop a deeper and more comprehensive understanding of each fleet’s and each driver’s unique risk profile, and then distill that data into insights and coaching that improve driving behavior and reduce risk.”

But even if it’s true that Fairmatic’s approach is better than most, the platform’s driver monitoring capabilities are concerning in their own right. They bring to mind algorithms Amazon has used to monitor delivery drivers’ behaviors during the workday. According to Vice, the algorithms incorrectly penalized drivers whenever cars cut them off — data that Amazon used to evaluate driving performance and determine individual bonus payouts.

In response to a question about monitoring and data privacy, Matus said that Fairmatic “only actively monitors data relevant to the insurance policy,” including information needed for risk and claims management. “Fairmatic’s technology layer uses anonymous data and doesn’t retain driver information without fleet permission,” he added.

Whatever the case, Fairmatic hasn’t had trouble attracting investors — or customers, for that matter. The startup raised $46 million in a funding round led by Battery Ventures with participation from current investors and Bridge Bank that closed this week, bringing its total funding to $88 million at double its previous valuation (Matus wouldn’t give a figure). On the client front, Matus says that it’s onboarded “hundreds of thousands” of drivers.

That’s not terribly surprising. Commercial auto insurance is a massive market, with Allied Market Research estimating that it’ll be worth $307.10 billion by 2030 — up from $128.44 billion in 2020. Bias risk aside, money talks — even at a time when global insurtech VC funding continues to cool.

Fairmatic’s near-term plan is to bring on 30 employees for its R&D hub in Israel and more in Bangalore, India, Matus said. The company’s current workforce — distributed across offices in the U.S., Israel and India — stands at 85 people.

“Fairmatic has seen outsized traction since our Series A and this new capital will be used to accelerate our lead in bringing the full power of AI to commercial auto insurance. Fairmatic is making strategic hires across the globe and we are accelerating the growth of our R&D hubs in Israel and in India,” Matus said. “Our vision is to build a tech-powered insurance platform that’s not only fully digital but also comprehensively improved and powered by AI, across every product and business function.”

Fairmatic raises $46M to bring AI to commercial auto insurance by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/03/16/fairmatic-raises-46m-to-bring-ai-to-commercial-auto-insurance/