Partners of 3one4 Capital, a venture capital firm in India, recently went on a road show to raise a new fund. Within two and a half months, at the height of the worsening global economy, they had secured $200 million. It’s the fourth marquee fund for the Bengaluru-headquartered fund, whose portfolio includes four unicorn startups.

The fund, sixth overall for 3one4 Capital, was oversubscribed to $250 million but the firm is accepting only $200 million to keep itself lean and disciplined, said Pranav Pai, co-founder and partner at 3one4 Capital. The firm’s decision to limit the fund size is emblematic of its strategic choices, which have set it apart from other Indian venture firms.

“We are known to give good returns. Our performance has been benchmarked among the best leading performing funds in the space. So we asked ourselves the hard questions, can we continue our performance with a larger fund size? Do we even need that much capital for the early-stage?” said Pai in an interview with TechCrunch.

In recent years, a surge of venture capital firms in India have raised unprecedentedly large funds, sparking concerns about the responsible allocation of this capital, particularly for early-stage startups. Critics question whether there are enough viable companies in the Indian market to absorb and effectively utilize such significant investments.

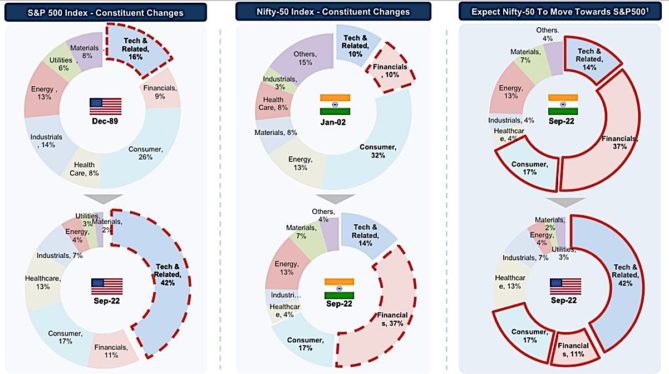

Pai, pictured above, asserts that there is ample room for more Indian companies to pursue IPOs, as the nation’s IPO market has proven successful and well-regulated for institutional investors. He anticipates a transformation in India’s stock index, with an increasing number of tech companies, apps, services, fintech, and payment solutions becoming part of the index.

A look at how S&P 500 Index and Nifty 50 Index have evolved over the decades and projections for future. (Image and analysis by Mirae Asset)

Despite this, Pai acknowledges that the Indian market has yet to fully realize its potential for mergers and acquisitions. Although there has been growth in M&A activity—increasing three to four times in the past five years—it remains below expectations. For the Indian market to flourish, Pai emphasizes the need for a more robust M&A landscape.

Over the last half-decade, numerous Indian venture firms have shifted their attention to early-stage investments. Despite this increased focus, the market continues to depend on international investors to support mid- and growth-stage deals, highlighting the need for further growth in India’s venture capital ecosystem. “We have high performing mutual funds and PEs. We hope that more of these firms will launch dedicated funds for Indian startups,” he said.

Half of the capital in the new fund for 3one4 has come from Indian investors, another aspect that differentiates the firm from many of its peers. All the systemically important Indian banks, and the top five local banks by market cap overall have invested in the new fund. Eight of the top 10 mutual fund operators are also LPs in the new fund, said Pai. “We are also proud to have leading global endowments, sovereigns and insurance companies as LPs,” he said.

“We want to be India’s leading homegrown venture capital firm. We are based here, we invest here – we don’t want to invest in Southeast Asia – and our fund size and strategy are aligned with opportunities in India. As our companies have IPO-ed over the years, we have seen the importance of having India’s largest institutions working with us to help build those companies. It would be difficult if we didn’t have banks to help our companies from everything from revenue collection to payrolls. And mutual funds are buyers, book runners and market makers for IPOs and them buying the stock gives a vote of confidence to the market,” he said.

3one4, which focuses largely on early-stage and in sectors including direct-to-consumer tech, media and content, fintech, deep technology and SaaS and enterprise automation, today manages about $750 million in AUM and its portfolio includes HR platform Darwinbox, business-to-business focused neobank Open, consumer-focused neobank Jupiter, Licious, a direct-to-consumer brand that sells meat, local social networks Koo and Lokal, entertainment service Kuku FM, fintech Raise Financial, and gaming firm Loco.

3one4 Capital has gained a reputation for its contrarian investment approach, as exemplified by its early investment in Licious. Over five years ago, the prevailing opinion held that India’s price-sensitive market would not pay a premium for online meat delivery. However, Licious has since grown into one of South Asia’s largest direct-to-consumer brands, with a presence in approximately two dozen cities across India.

Another example of 3one4’s daring investments is Darwinbox, a bet made at a time when most investors doubted the ability of Indian SaaS companies to expand internationally or garner sufficient local business subscriptions.

3one4 Capital’s contrarian approach extends to the investments it has deliberately avoided as well. In 2021, amidst a frenzy of investment activity in the crypto space, nearly every fund in India sought opportunities and backed crypto startups. However, 3one4 Capital, after thorough evaluation of the sector, chose not to make any investments in crypto.

The firm, which employs 28 people, is also focusing on setting new standards in transparency and governance for itself. It’s the first VC to be a signatory to UN PRI, it said. “We have to report, behave, act and look a certain way. We have to look like the fiduciary of best institutions in the world, and then and only then we quality to tell our portfolio founders that this is how we want to create best in class companies with you,” said Pai.

3one4 Capital, driven by contrarian bets, raises $200 million new fund by Manish Singh originally published on TechCrunch