The IFPI’s annual figure for global recorded music revenue, announced Thursday (Mar. 21) for 2023, is the gold standard for tracking the health of the music business. It’s the number most often cited in corporate reports, market research and media articles. It’s also a bit outdated.

Traditionally, record labels have sold and streamed music, secured synch licenses and collected performance and neighboring rights royalties. But a modern record label also collects expanded rights revenues — from multi-right, 360-degree recording contracts — by taking a share of artists’ income from merchandise, touring and branding, among other sources. Those expanded rights revenues aren’t part of the IFPI’s annual revenue tally, but MIDiA Research includes that — and more — in its annual estimate.

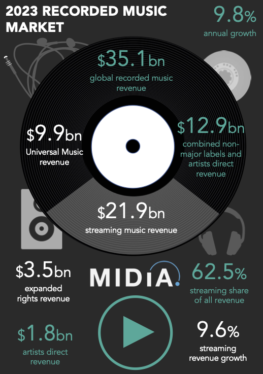

MIDiA’s more fulsome figure for global recorded music revenue in 2023 was $35.1 billion, nearly 23% higher than the IFPI’s $28.6 billion. According to MIDiA, which tells Billboard its estimate came from publicly available information and interviews, expanded rights revenue totaled $3.5 billion in 2023.

Some expanded rights revenue is in plain sight. Universal Music Group, for example, took in 706 million euros ($764 million) of merchandising revenue from Bravado, its wholly owned merchandise company, in 2023. For other companies, expanded rights are harder to pin down. Warner Music Group had $744 million of artist services and expanded-rights revenue in 2023. WMG’s expanded rights includes merchandising, VIP ticketing, fan clubs, concert promotion and management, according to its latest quarterly report.

Neither global revenue figure is right or wrong; they’re just different. The IFPI’s revenue figures reflect how labels monetize the rights associated with master recordings through sales, streaming and licensing. MIDiA’s revenue figure acknowledges the role of record labels has expanded far beyond monetization of masters.

Even the term “expanded rights” is problematic because it suggests merchandise and branding isn’t central to a record label’s mission. That isn’t necessarily the case in 2024. Consider the wave of K-pop companies expanding globally out of South Korea. HYBE, home of boy band BTS, is a hybrid record label, talent agency and management company with a slow, painstaking artist development process and a business model that captures far more than recorded music sales. In 2023, 55% of HYBE’s revenue came from sources other than recorded music. Concerts accounted for roughly 16% of revenue, merchandise and licensing were 15%, and ads and appearances were 7%. In fact, MIDiA estimated that Korean labels — including SM Entertainment, YG Entertainment, JYP Entertainment and Starship Entertainment — accounted for nearly 70% of non-major-label expanded rights revenue.

Another difference between the IFPI and MIDiA reports is the latter’s emphasis on the fast-growing independent artist community. Easy access to recording tools and distribution has gotten the everyday artist’s recordings on digital platforms around the world. MIDiA estimates there was $1.8 billion in “artist direct” revenue in 2023. Artist direct is a category of self-publishing, independent artists who use self-serve platforms like DistroKid and TuneCore, and MIDiA’s 2023 Creator Survey estimated there are 6.4 million artists in this segment. While 38% of these independent artists aspire to be full-time musicians, 36% do not expect to focus on music as a sole career. Deducting expanded rights and artist direct revenues from MIDiA’s $35.1 billion estimate narrows the difference between that and the IFPI’s $28.6 million figure.

Another difference between the two reports stems from MIDiA’s inclusion of revenue from production libraries in its synch revenue figure. Production music — which spans everything from beat marketplace BeatStars to online library Epidemic Sound — often exists outside of the record label system that traditionally develops and markets artists. Unlike artist-oriented music, production music is often nameless and faceless content that advertisers and other content creators license for its specific sound and style rather than artist name recognition. Lacking star power is the point, however: Production music libraries are increasingly popular amongst content creators in need of affordable background music.

Broader measurements will be crucial for tracking the recorded music business of the future. Record labels will pursue “superfans” through products and services that may not produce typical sales and streams. Artificial intelligence will create new licensing opportunities. Greater adoption of the K-pop model will change what it means to be a record label. When that happens broadly, $28.6 billion of annual revenue will be a starting point. Judging by MiDIA’s 2023 report, it already is.

https://www.billboard.com/pro/music-revenue-2023-why-ifpi-midia-numbers-different/