You may have heard of ID fraud, and you might think that it's the same thing as identity theft or credit card theft. However, there are some differences between these three problems that can help you understand each one better. By recognizing the specific risks associated with each type of fraud, you can take appropriate action to protect yourself.

What is identity theft?

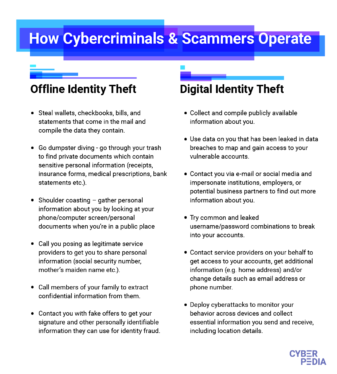

Identity theft is the act of stealing someone's personal information, which can be used to impersonate the victim. This can happen to anyone, including adults, children, and even deceased individuals. Offline methods of stealing someone's identity include checking their trash for discarded financial documents, stealing their mail, or taking their wallet or purse. These items can provide enough information to take out credit in the victim's name.

However, identity theft is mainly an online crime these days and often involves phishing scams. Scammers will send emails or messages that appear legitimate, tricking people into giving away their login details for banks or credit card websites. With this information, a thief can easily steal someone's identity.

To begin stealing someone's identity, a scammer needs their name, date of birth, and address. They can also use social media to gather more information about the victim, which can make the scam more convincing.

If you suspect that your identity has been stolen, it's important to contact your bank, credit card company, and the police immediately.

What about ID fraud?

Identity theft can lead to identity fraud, which occurs when someone uses another person's identity to commit fraudulent activities. Fraudsters can deceive banks or credit card companies into handing over money and personal information about the victim. They can use the stolen details to open new bank accounts, apply for new credit cards and loans, acquire state benefits, order goods, take out mobile phone contracts, take over existing bank, credit, and property accounts, and even obtain legitimate copies of official documents such as passports and driving licenses.

What is credit card theft?

Card theft is a common type of criminal activity where a thief may steal your credit or debit card in order to use it for their own benefit. There are three main types of card theft: physical theft, cloning, and skimming. Physical theft refers to the scenario where your wallet is stolen. A card can be cloned following physical theft, or data can be skimmed from it and stored in a database. This data is then used to create a new fake card that can be used as a genuine credit card.

Skimming is a major risk associated with paying by credit card. Skimmer technology is a compact method of copying the data stored on your credit card. This data can then be used to buy goods or services charged to your account. Unfortunately, not only is there potential for restaurant and café employees to carry skimmers, but ATMs and gas station “pay at the pump” systems are also prone to interference and are at risk of a skimmer being installed.

Credit card theft often results in credit card fraud. This involves the use of the stolen card to buy goods or services, which are then delivered to a remote location, such as an industrial estate unit. Alternatively, the criminal may transfer money (through a fake “payment”) to an account that they manage.

The differences between ID fraud, identity theft, and credit card theft

Now you know and understand what ID fraud is, along with identity theft and credit card theft. The differences should be pretty clear, but if not, here's a recap:

- ID fraud is fraudulent activity (taking out loans, extending credit, even acting in an official capacity) using someone else’s stolen identity.

- Identity theft is the act of stealing an identity. It might be done offline or online. Identity can also be bought or sold online – some are stolen to order.

- Credit card theft encompasses credit cards and debit cards. It refers to stealing (or duplicating) a card to use it for personal gain or transferring the balance to another account with a fake payment.

All these things are bad, but you can reduce your exposure to them:

- Dispose of old bank statements and correspondence

- Keep important documents safely locked away

- Reduce social media activity and friends

- Set a different password for every account, using a password manager

- Enable two-factor authentication where available

- Set a secure PIN or fingerprint authentication on your phone

- Subscribe to SMS balance alerts with your bank and credit card provider

- Sign up for monthly credit reports to check for credit applications in your name

ID fraud, identity theft, and credit card theft: Three sides of the same problem

The theft and subsequent fraud explained here are all linked. Not having a credit card won't stop identity fraud. Going off-grid won't prevent identity theft. These are aspects of modern life enhanced by our reliance on instant connectivity into simultaneous benefits and threats.

Be aware of the differences between ID fraud, credit card, and identity theft. But remember that the issues are linked, and behaving in a manner that keeps your data personal will help considerably.

More from TechRadar Pro

- We’ve highlighted the best password manager

- Protect your privacy online with one of the best VPN services

- These are the best anonymous browsers on the market

- We’ve also highlighted the best identity theft protection